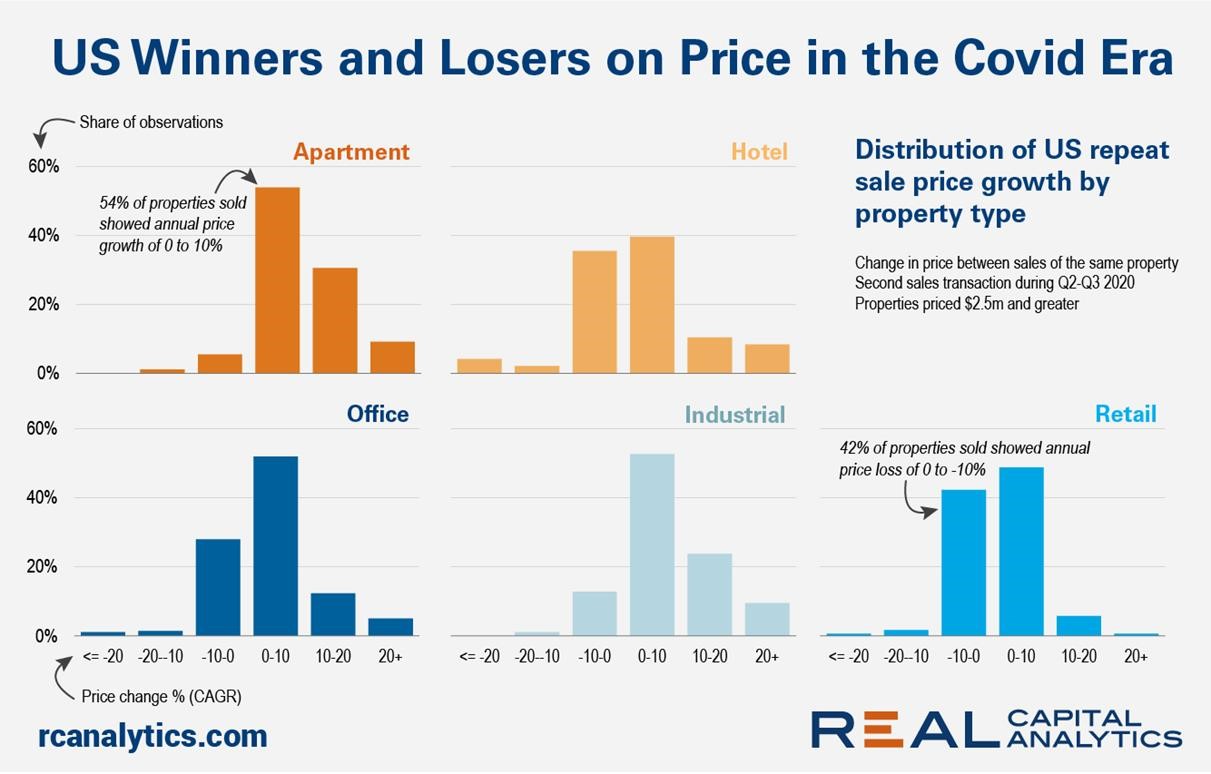

Real Capital Analytics released a report that describes the impact of COVID-19 on real estate sales price, across multiple asset classes, throughout the United States. While apartments and industrial assets have seen resilience and even annual price growth; the same cannot be said for the hospitality and retail sectors.

Apartments & Industrial

Apartments have stayed strong with 54% of trades displaying an annual price growth of 0-10%, Even more notable, less than 15% percent of all apartment transactions exhibited any price loss. The other winner is industrial with over 80% of assets experiencing annual price growth. The increase attraction to industrial is due to the rise of e-commerce demand during the pandemic.

Hotel & Retail

Just over half of all hospitality trades showed no signs of price growth, while an estimated 5% have experienced a 20% price loss. Similar to the hospitality industry, retail properties experienced a negative impact by COVID-19, with 42% of properties experiencing a 0 to 10% of annual price loss.

Boston Realty Advisors is transacting and sees great opportunity for sellers in a market with such limited inventory of commercial product.

Thank you Real Capital Analytics for providing insight to the impact of COVID-19 on real estate sales price in the United States.