Market Highlights

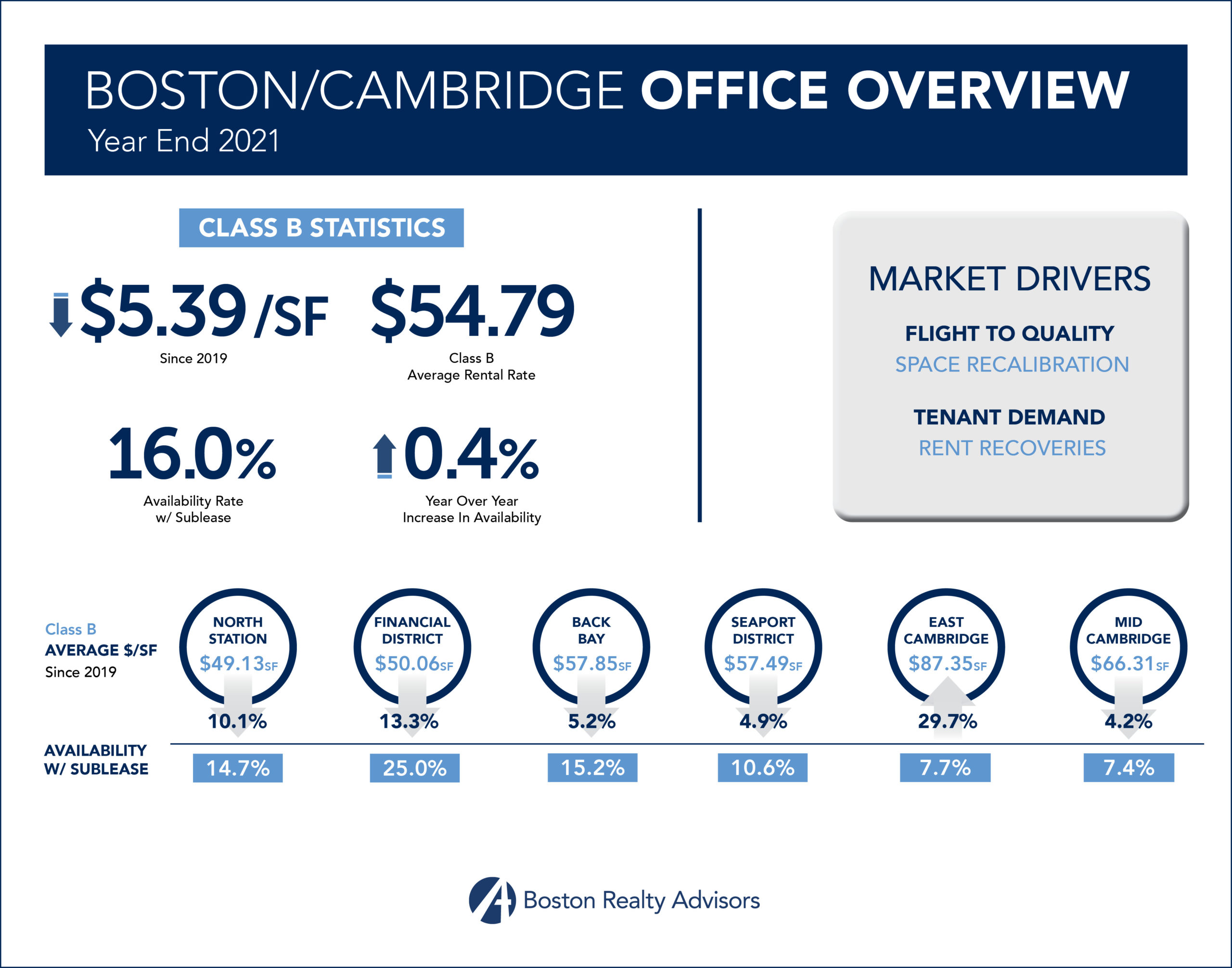

The Class B market availability stabilized beginning in the 2nd quarter of 2021 showing a modest increase year of year from 2020. Modest leasing activity and tenants recapturing spaces from the sublease market offset the Q1 2021 spike in availability.

The Seaport/Fort Point outperformed all other markets as lab conversion removed inventory and subleases were absorbed by new tenants or recaptured as companies returned to the office.

Asking rents continued to recalibrate down; however, the pace year over year change was modest and rent have stabilized going into 2022.

New deal activity was healthy in the 2nd half of 2021. Rent concessions, free rent and TI, were up significantly from 2019 as landlords competed to fill vacancy. Net effective rents on new deals were as much as 10% below face rents.

Forecast

With availability stabilized, a market recovery will begin marching through its early innings.

Consistent tenant demand, even modest, will create needed momentum for the market to gain footing and develop tangible data points for landlords and tenants.

Increased concession packages will persist into the 1st half of 2022 as landlord competition for tenant demand remains high.

Provided healthy deal activity persists in the 1st half of 2022. optimism in the market will begin to drive rents back up. In contrast, deal concessions are likely to persist as high construction costs and labor/material shortages weigh heavily on tenant decision making forcing landlords turnkey space.

Ready to go high quality spaces and spec suites have and will continue to be the best recipe for success as tenants look for value in flexibility and more immediate occupancy.

Tags: Boston, cambridge, Class B, Class B Statistics, Forecast, Market, Market Drivers, Market Highlights, office overview, Year End 2021