Market Highlights

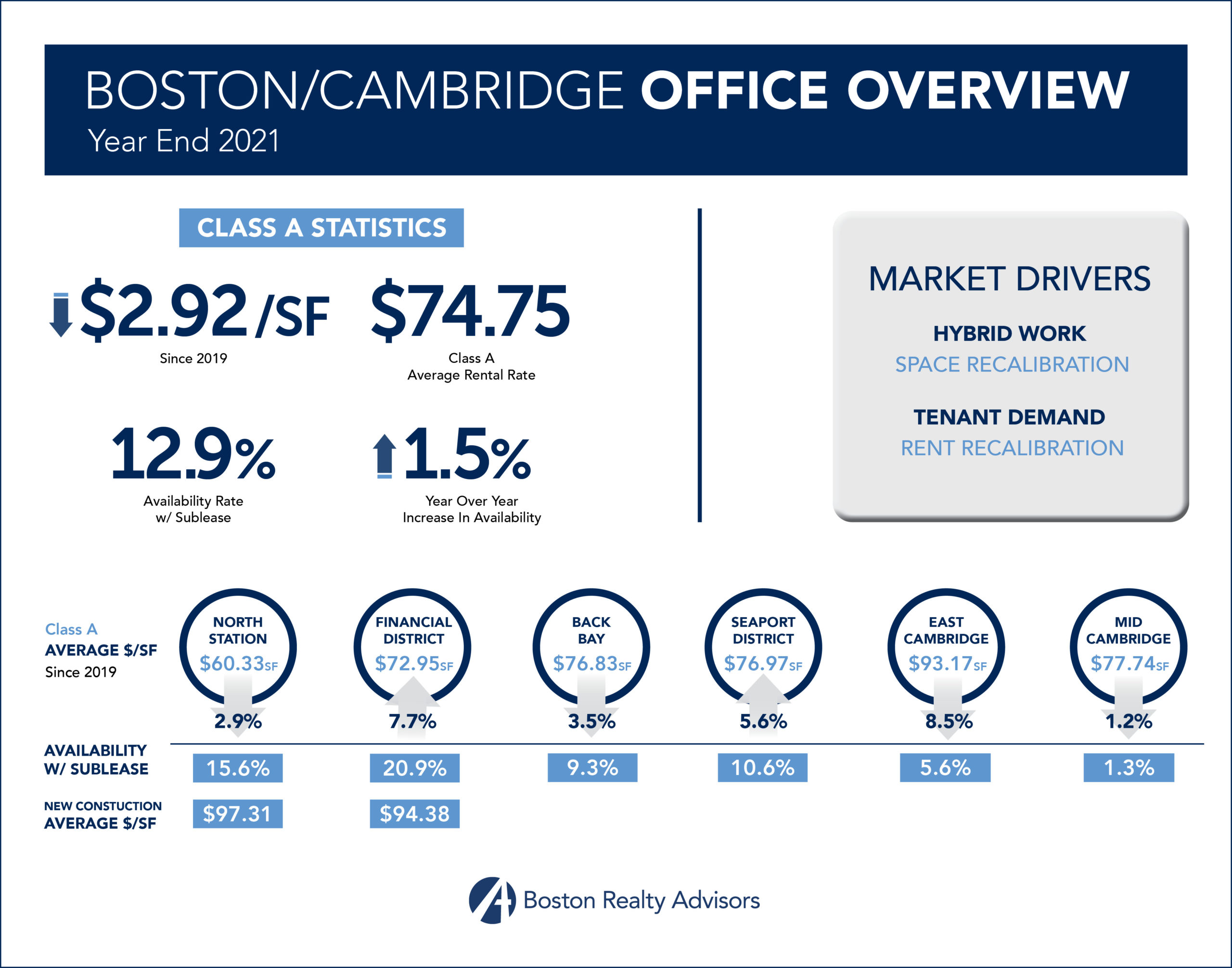

The Class A market experienced a significant increase in availability across all submarkets, with only the Seaport/Fort Point as the exception.

New construction outperformed the existing inventory; pre-leasing or securing larger tenants seeking flight to quality.

Demand overall continued to be hindered by the Pandemic; however, an uptick in Q3/Q4 leasing activity has provided momentum headed into 2022.

Despite significant increases in availability, Landlords have held asking rents near 2019 levels and the increased availability on higher floors impacted the overall weighted average asking rents up.

Acquisitions of existing Class A buildings for Lab conversion was the biggest story of 2021.

Forecast

Lab conversions will continue to impact the market, displacing office tenants and removing existing inventory.

Landlord’s patience with asking rents will be tested as competition for tenancy increases.

Prolonged vacancy and inconsistent demand will be the determining impetuses for further rent recalibration.

High construction costs and labor shortages are expected to persist in 2022, expect deal concessions to remain favorable to tenants to entice them to relocate.

Quality subleases and new spec suites will see the greatest demand as tenants look for value in flexibility and more immediate occupancy.

Tags: Boston, cambridge, Class A Statistics, Market Highlights, office overview, Year End 2021