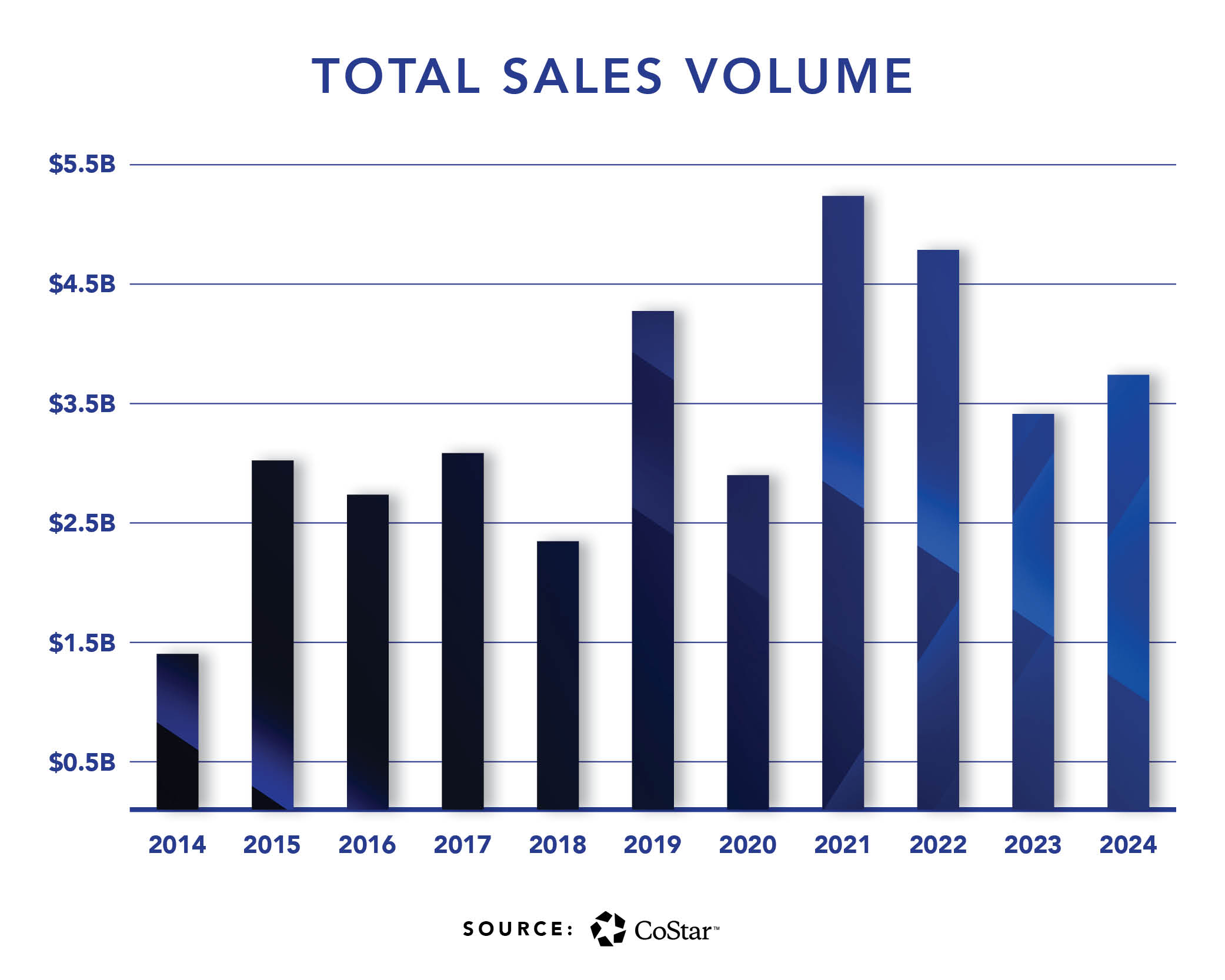

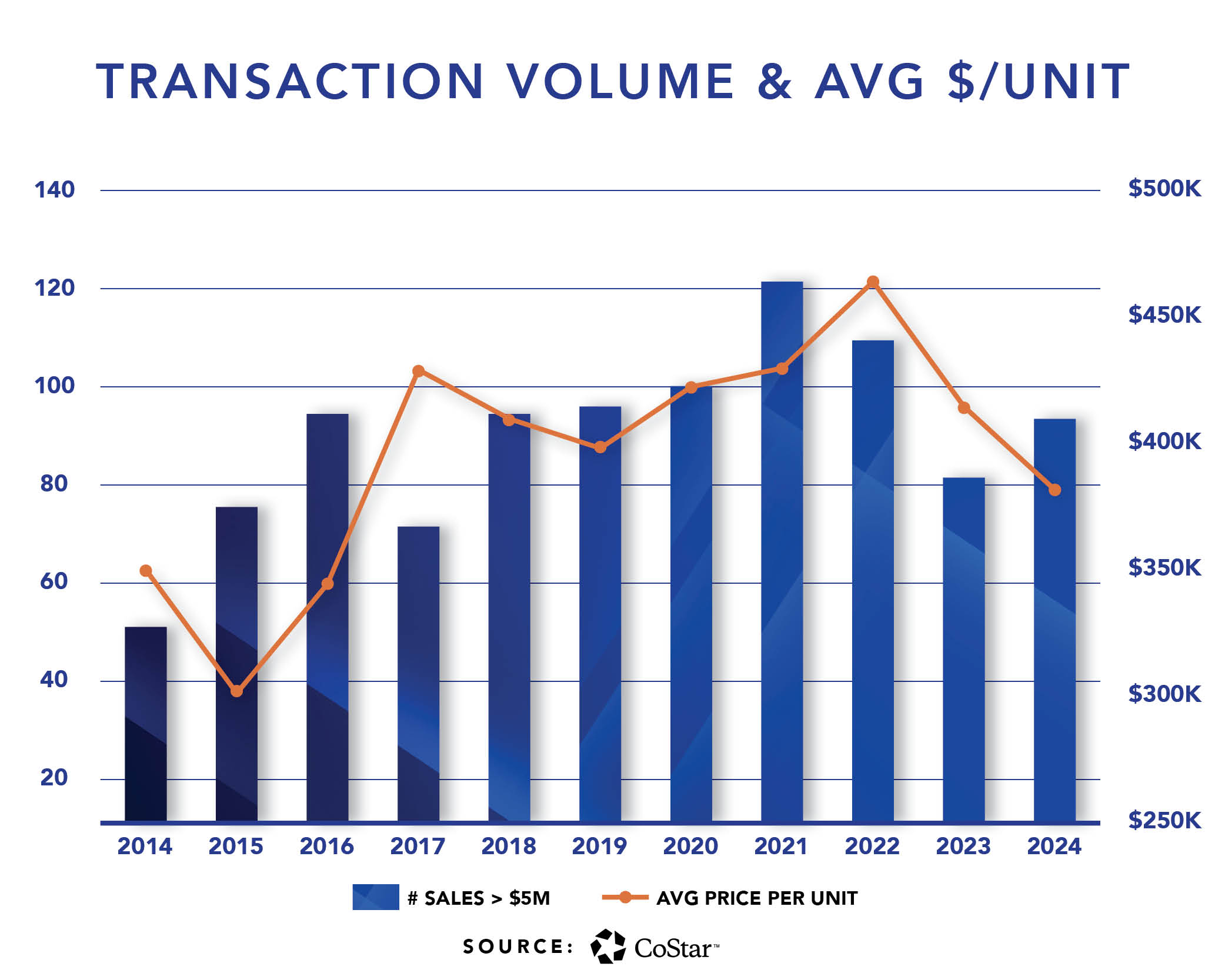

The Boston multifamily real estate market has long been a cornerstone of investment activity in the region. This report analyzes sales data for Boston multifamily sales of greater than $5,000,000 since 2014, focusing on trends from 2024 and providing a forecast for 2025. The accompanying graphs highlight key metrics such as total sales volume, average price per unit, and transaction activity, illustrating the resilience and evolution of the market over the past decade.

2024 Market Analysis

Total Sales Volume:

- Observation: 2024 recorded the fourth-highest total sales volume ($3.7B) in recent years (93 sales).

- Insight: This robust activity underscores sustained investor interest and market resilience, even amidst higher interest rates.

Average Price Per Unit:

- Observation: There is a noted decline in average price per unit compared to peak years.

- Insight: This pricing adjustment aligns with cap rate expectations and yield requirements in a rising interest-rate environment.

Transaction Volume:

- Observation: The number of trades in 2024 remained consistent with prior years, suggesting stable market liquidity. The exceptional sales volumes of 2020 and 2021 were anomalies, driven by historically low interest rates.

- Insight: When viewed in this context, 2024’s performance is historically strong, and representative of a more normal long-term trend. This stability points to sustained investor confidence and a balanced market environment.

2025 Market Forecast

Interest Rate Environment:

- Projection: While interest rates are expected to remain elevated, they may stabilize or slightly decrease, influencing cap rates and pricing strategies.

- Insight: Investors should anticipate continued alignment of pricing with interest rate moves and cap rate expectations. For better or worse, our industry is interest rate driven.

Transaction Activity:

- Projection: With five-year loan rate resets approaching for acquisitions made in 2020, there may be an uptick in market activity as owners reassess their positions.

- Insight: This scenario could lead to increased opportunities for acquisitions and dispositions, contributing to a dynamic market landscape.

Supply and Demand Dynamics:

- Projection: A slowdown in multifamily construction in Boston is anticipated in the next few years. Completions in 2024 are expected to total approximately 7,000 units, the smallest since 2016, with tighter supply conditions projected for 2025.

- Insight: This reduction in new supply may bolster occupancy rates and support rent growth, bolstering property valuations even with a higher interest rate environment.

Investor Sentiment:

- Projection: Multifamily real estate in Boston is poised to remain a preferred asset class for investors, with strong renter demand driving improving occupancy and accelerating rent growth.

- Insight: The sector’s resilience and adaptability continue to attract investment, fostering a positive outlook for 2025.

Conclusion

The Boston multifamily real estate market in 2024 demonstrated significant strength, with total sales volume and transaction activity reflecting a healthy and resilient sector. Looking ahead to 2025, while higher interest rates may influence pricing, the anticipated increase in market activity due to loan resets and a slowdown in new construction suggest a dynamic environment with opportunities for growth and investment. Investors and stakeholders should remain attentive to interest rate trends and market dynamics to strategically navigate the evolving landscape.