Boston’s office market in particular is one of the country’s strongest and is currently ranked as the 6th tightest office market nationwide. The most recent announcement of GE moving its world headquarters to Boston’s Seaport combined with established fortune 500’s and a continued influx of new startup technology and life science companies, make Boston’s office market truly dynamic and world class.

New economy companies, particularly startup technology firms, are Boston’s strongest demand driver for office space. Fueled by a millennial employee base and stiff competition to attract top talent, technology companies are absorbing office space at a healthy pace in an already tight market.

Boston’s middle market or Class B market has experienced a tremendous renaissance from this trend as cool and creative office space design drives adaptive reuse of a turn of the century inventory. Open plan loft style space is replacing drop ceilings and perimeter offices citywide.

The influx of foreign and institutional capital into the middle market is supporting the new economy tenant demand by investing into the middle market buildings with upgraded common areas, new amenities and tenant improvement dollars, all in exchange for higher lease rates exceeding previous all-time highs.

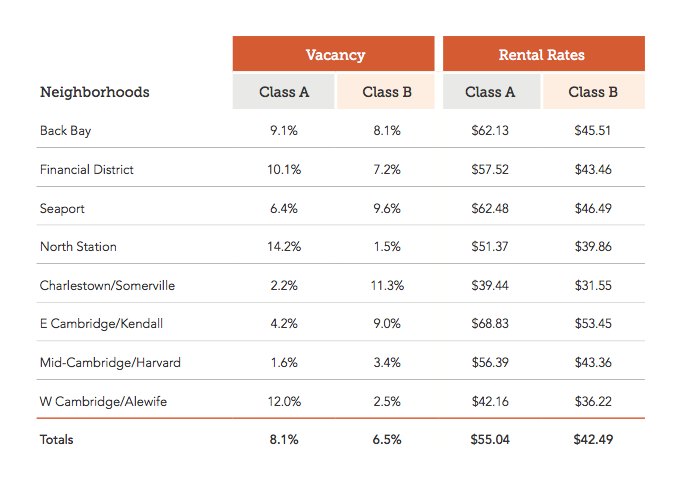

Market fundamentals are expected to remain strong with healthy demand, stable rent growth and low vacancy for the foreseeable future. Tenants will have fewer options and will be forced to consider multiple markets and more tertiary areas to satisfy economic and/or space restraints.

With tenants leading the charge into more creative product in submarkets like: Seaport, Somerville, Allston/Brighton, Charlestown and the South End, the landscape of Boston real estate will continue to expand into non-core submarkets.

Tags: Boston Office Space, Office Rental Market, Office Rents