Prominent Renovated Downtown Office and Retail Property BOSTON – Boston Realty Advisors, the Boston area’s largest independent commercial real estate brokerage, represented the owners of 399 Washington Street in the sale the prominent Downtown retail and office property that had long been vacant. A bank lender, which had taken the property back from a previous […]

Read MoreInsights

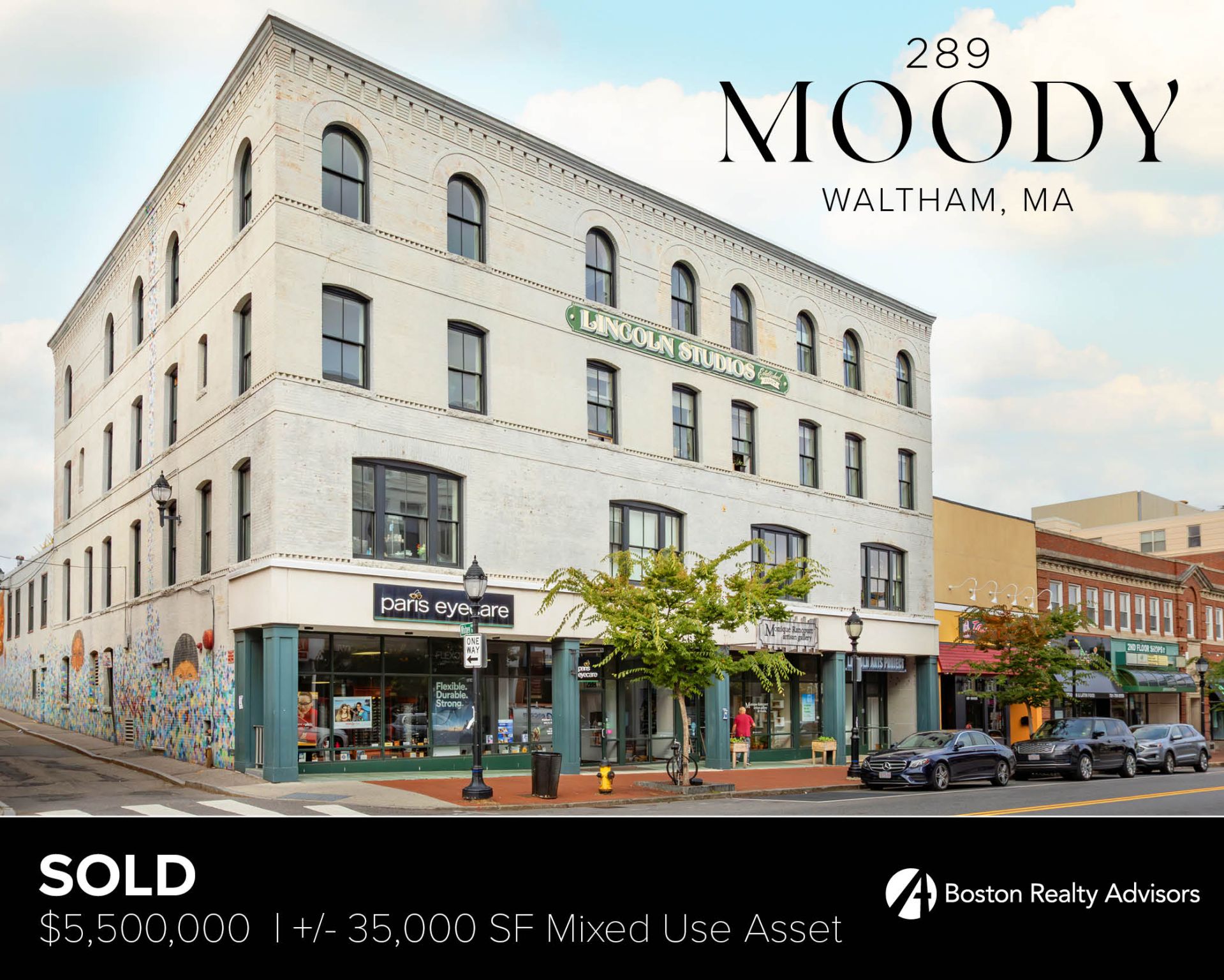

Boston Realty Advisors is pleased to have completed the sale of 289 Moody Street

Capital MarketsLeave a commentBoston Realty Advisors is pleased to have completed the sale of 289 Moody Street, a +/-35,000 SF mixed-use asset that consists of retail, artist studios and residential units. “289 Moody Street has become an important part of the fabric of Moody Street. The previous owner created a unique space which serves the artist community and […]

Read More

Boston & Cambridge Office Markets – 2024 Year-End Review The Boston and Cambridge office markets demonstrated remarkable resilience in 2024, supported by the region’s core strengths: innovation, a diversified economy, and world-class educational institutions. These factors have reinforced businesses’ commitment to maintaining a physical office presence, contributing to overall market stability. Key indicators—including stable asking […]

Read More

Empty since 2006, this downtown building is back on the market

Boston Commercial Real EstateLeave a commentThe newly redone facade of 399 Washington St. in Downtown Crossing. DAVID L. RYAN/GLOBE STAFF The 76,000-square-foot retail and office building at 399 Washington St. is up for sale for the first time since 2017 By Christopher Gavin Globe Correspondent, Updated July 5, 2024, 12:01 a.m. The last time shoppers walked through the doors of 399 […]

Read More

As interest rates are expected to stabilize in 2025, with 10-year Treasury yields projected to settle between 3.75% and 4.25%, CRE investors must align their strategies to navigate the evolving rate environment. Here are key considerations and strategies: Debt Capital Markets Strategies Fixed vs. Floating Rates: The anticipated moderation in interest rates and a return […]

Read More