Fenway’s Real Estate Home Runs

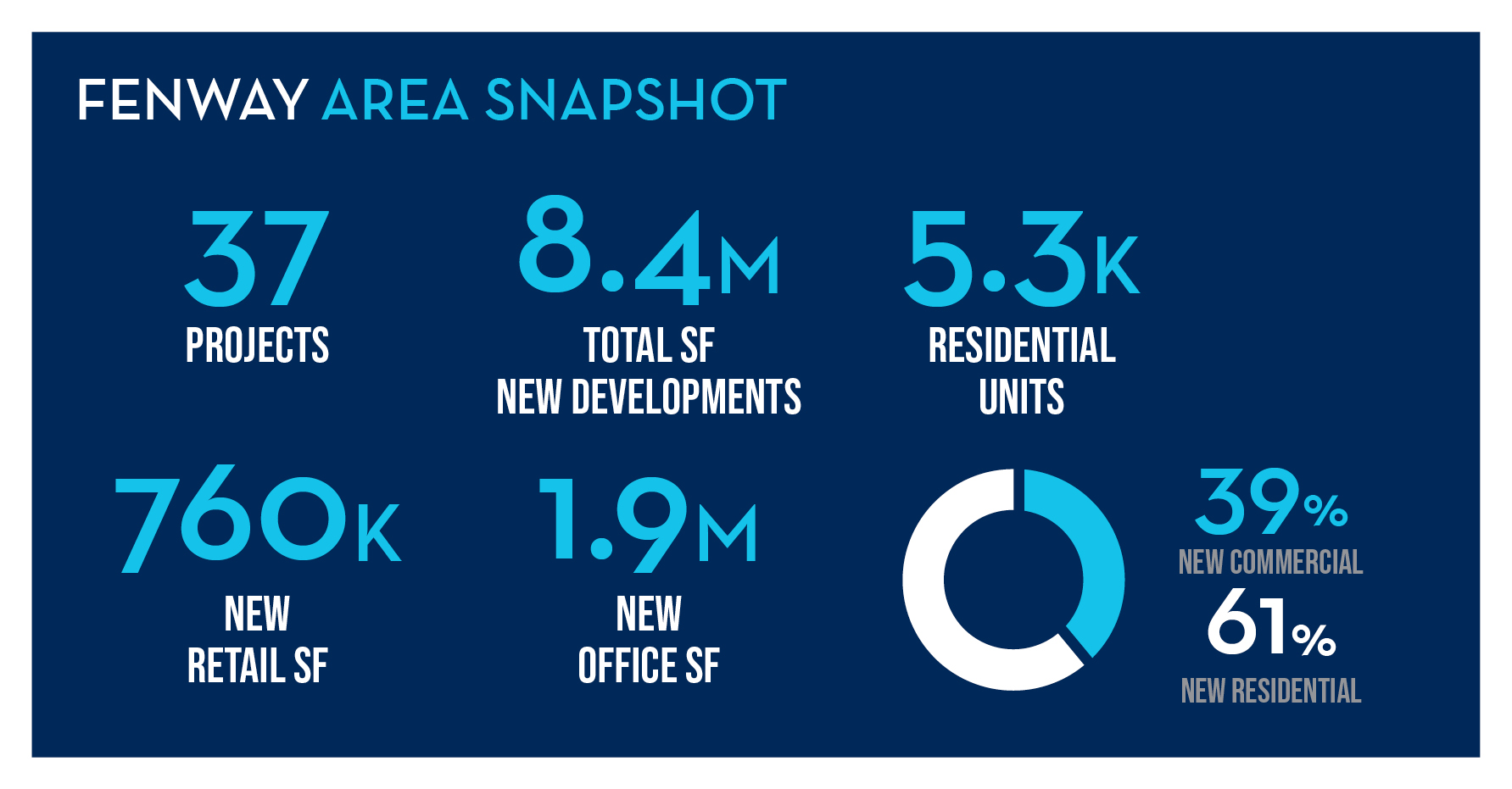

The thriving Fenway submarket is a commercial and cultural hub that has undergone a transformation from primarily student housing mixed with under-developed retail and former light-industrial spaces, to a thriving mecca of mixed-use community occupied by a diverse pool of young professionals, empty nesters and foreign investors. Connectivity to the Longwood Medical Area, and other world-renowned medical institutions, along with rising rents in other Boston submarkets, has provided Fenway a growing base of steady renters and condo buyers. In addition to a plethora of bustling new restaurants, shops, and a wave of new multi-family inventory, there has never been a better time to live, work and play in the Fenway district.

Over the past five years, Fenway has seen extraordinary growth, particularly from developers Samuel & Associates and Skanska. The recent opening of 200 Brookline, The Harlo, Van Ness, and Viridian have added 1,075 units of luxury apartments into the market; and, with another 485 units planned, Fenway is rapidly becoming a sizeable residential submarket and slightly-less-costly alternative to the Back Bay. Though still expensive by most standards, last year’s average Class-A apartment average asking rents were $5.19 PSF in the Back Bay as compared to $4.61 PSF in the Fenway.

The rapid completion among new developments has created a hyper-competitive, concession-driven market during lease-up phase. As of Q2 2018, the recently opened 200 Brookline reached 32.9% occupancy since February and is offering one month free rent; the Harlo, a 2017 delivery, is also offering one month free, is 65% occupied and 80% pre-leased – a strong market indicator after 8 months since move in. The 2015-vintage Van Ness and The Viridian have been stabilized at 95% occupancy, achieving this milestone in late 2017, suggesting it took nearly 2.5 years for full absorption of their combined 512 units.

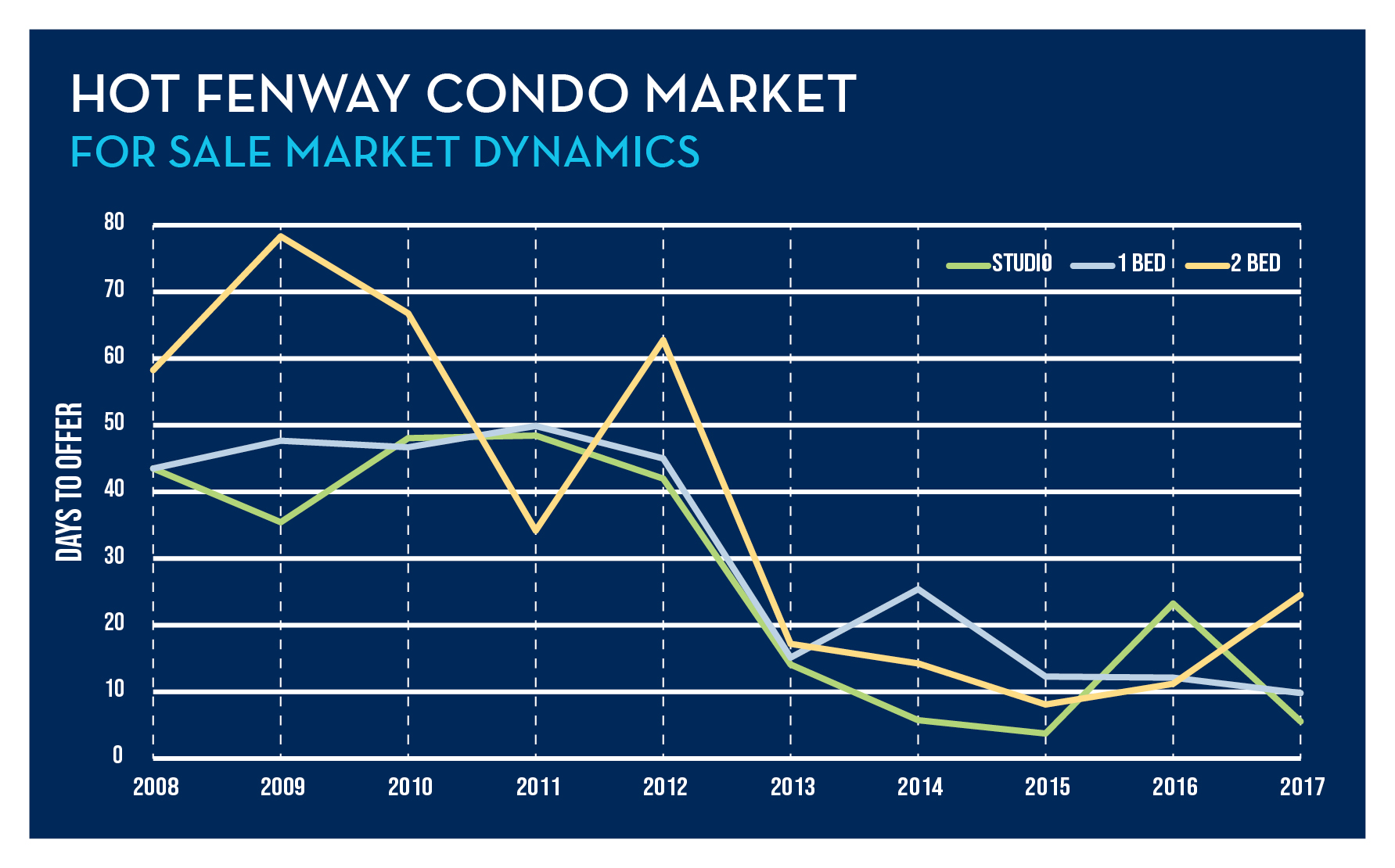

Even with a stream of new condominium developments such as Pierce, the number of For-Sale units sold are down 66% between 11 sales in Q1 2018, and 32 sales in Q1 2017. In 2016, there were 77 condominiums sold at an average of $805/sf and in 2017 there were 114 condos sold at an average of $925/sf further representing the absorption cycle of new developments. Still, there appears to be a market for the “old-style” Fenway properties. For instance, last month, 66 Queensberry Street, Unit 316 fetched $1,148 PSF.

Regardless of your preference, there is both a high supply of new multi-family inventory and the demand to support it. Prices are up in the condominium market, and though a discount to Back Bay and South End, as Fenway continues to develop and evolve, it may not be long before they too are put in the same categories as more established submarkets.

Tags: Condo, Fenway, Jason Weissman, Multi-Family, Redevelopment, Residential Real Estate